Last month one of China’s most powerful oil executives caused a stir in markets with a stark prediction: that the country’s oil demand may peak this year.

Asked how the slowdown in China’s economy might affect domestic demand, Zhou Xinhuai, chief executive of Cnooc, said he expected the second half of 2023 to be weaker than the first, indicating a slowdown in demand year-on-year and meaning that “perhaps this year China’s domestic oil demand will reach a peak”.

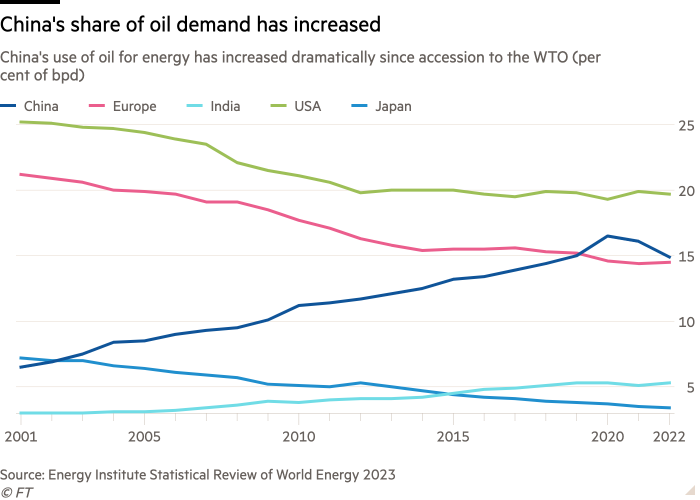

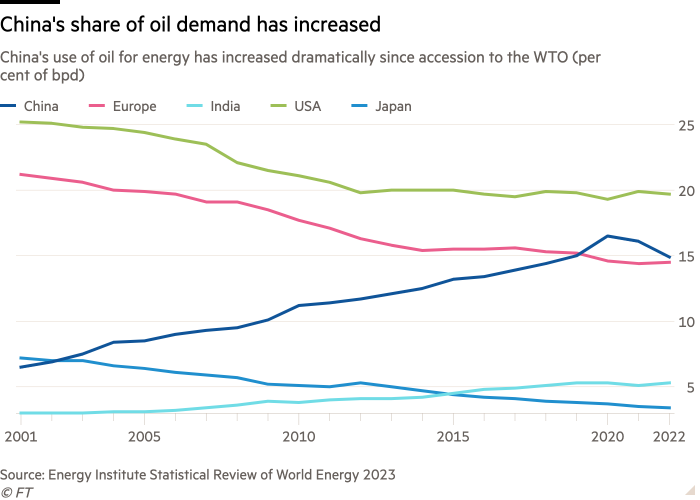

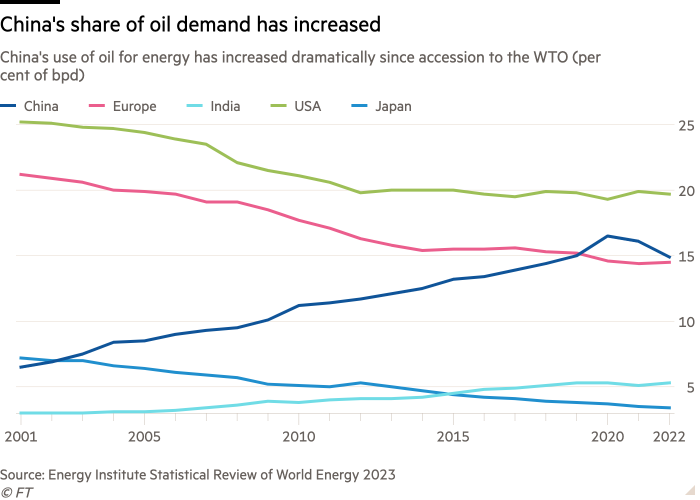

That may overstate the case; the International Energy Agency (IEA) does not expect demand to plateau until 2027 and peak in 2030, as part of a general shift away from all fossil fuels. But whenever the date, analysts agree that China — where the IEA says oil demand has trebled over the past two decades — is getting close to an inflection point that will reverberate across the industry.

“We’re going to see China’s oil demand peak by the end of the decade, and then global oil demand,” said Neil Beveridge, senior energy analyst at AB Bernstein.

“China’s market is a microcosm of the world. What’s going on there reflects how the world oil market is changing,” said Ciarán Healy, oil market analyst at the IEA.

At the heart of China’s waning thirst for oil is the country’s rapid take-up of electric vehicles, with the country’s own carmakers at the fore. EVs made up 37 per cent of all new car sales in China last month, according to figures from HSBC Global Research.

As China’s EVs take over the car market, the country’s reliance on imported crude is decreasing, precipitating a shift in China’s energy mix.

China’s energy mix will shift towards coal and renewables

China has been the engine of global oil demand since its accession to the World Trade Organization in 2001. About half of the global increase in oil demand since 2000 has come from China, which has trebled its consumption over that period, according to estimates by BP.

But China’s role as linchpin of the world oil market, even as its growth slows, obscures the fact that oil is arguably not the most important part of China’s energy mix, and its dependence is rapidly shrinking as EV penetration increases.

Michal Meidan, head of China research at the Oxford Institute of Energy Studies, says oil accounts for only 19 per cent of the country’s energy mix. “From an energy system perspective, China is probably self-sufficient for 85 per cent of its energy needs,” she said.

By electrifying the vehicle fleet “they gradually reduce reliance on gasoline and imported oil. That’s where coal and renewables come in”, Meidan added.

According to BP’s most recent Statistical Review of World Energy, coal accounts for 56 per cent of energy supply in China, against a world and OECD average of 27 per cent and 28 per cent respectively.

Oil and gas account for only 26 per cent of energy supply in China. Renewable energy accounts for the balance.

As the power for China’s cars increasingly comes from the electricity grid, its reliance on domestically sourced coal and renewables increases — reducing its dependence on other countries.

Where other OECD countries have switched from coal to cleaner fossil fuels such as natural gas, China has instead focused on a leap from coal to renewable energies. An intermediate switch to gas would increase dependence on the global energy market.

“China’s big energy independence story of the future is this base layer [of coal and other fossil fuels], with a layer on top driven by renewables and batteries,” said Lin Ye, a senior analyst at Rystad, a research firm.

What less oil means for China’s climate targets

In 2012, China altered its constitution to put sustainability at the centre of national policymaking. In September 2020, at a speech to the UN General Assembly in New York, China’s president Xi Jinping committed the country to hit peak emissions before 2030 and carbon neutrality by 2060.

China’s carbon targets are short of other OECD nations, most of which are targeting reductions in emissions between 25 and 30 per cent before 2030, and carbon neutrality before 2050. India has set its carbon neutral target at 2070.

In context however, they are ambitious; while China’s economy is large, it is also relatively poor on a per capita basis. The IMF estimates that GDP per capita in China is less than a quarter than that of the US.

This means China must balance resource-intensive growth programs with carbon-reduction initiatives. According to EU figures from 2020, China’s annual carbon emissions per capita are only 60 per cent of the US figure.

Though the country is expected to meet its targets, the tension between the green transition and energy security remains a challenge.

“Energy security has become a priority for the country since last year, because of geopolitical issues,” said Evan Li, head of Apac energy transition research at HSBC.

High energy prices and supply shortages have “obviously caused a lot of nervousness”, Li said. “So recently we’ve seen a relaxation in the use of coal and fossil fuels in general. That’s one of the things that might slow China down.”

Petrochemicals start to drive China’s oil market

As peak oil gets nearer, the oil market in China and elsewhere is being increasingly driven by demand for non-fuel products — mainly petrochemicals products. According to the IEA, petrochemicals will account for 85 per cent of incremental global oil demand growth before 2030.

That will prompt oil refiners in China and elsewhere, which have traditionally been driven by the need to produce transport fuels, to invest heavily to rework their capacity.

“You can no longer look at the macro-picture, you need to start thinking about individual products,” said Mukesh Sahdev, head of oil trading at Rystad Energy. “For refiners, it’s not going to be business as usual.”

China, which is already the world’s largest producer of petrochemicals, is set to extend its lead. According to data from JPMorgan, China has added 22.2mmtpa of ethylene production since 2017, and is set to add a further 15.1mmtpa before the end of 2025.

“The transition that has already happened in China is increasingly happening elsewhere in the world,” said Parsley Ong, head of Asia energy at JPMorgan. “New capacity the world over is increasingly being geared towards chemicals.”

And because the new capacity includes technology that allows chemical feedstocks to be produced directly from crude and fuel oil, China will be able to cut its dependency on petrochemical imports — and increase the resilience of its manufacturing supply chain.

Dealmaking for the new oil world is rising

Demand in China for petrochemical experience and technology has spurred a flurry of deals with overseas companies. Inbound investment in petrochemicals since the start of 2022 has exceeded $5bn, according to data from Dealogic.

Last month Sinopec signed a joint venture with Ineos of the UK for a project to produce ethylene in Tianjin. And in July Saudi Aramco, the national oil company of Saudi Arabia, purchased a 10 per cent interest in Zhejiang-based Rongsheng Petrochemicals, owner of 51 per cent of Zhejiang Petrochemicals (ZPC), for RMB 24.6bn ($3.4bn).

This is the latest in a spate of Saudi-Chinese petrochemical deals over the past year in which Aramco has lavished funding and petrochemical knowhow on Chinese refiners in return for long-term commitments to buying oil.

China’s state-owned companies are also transforming themselves, raising capital expenditure in what analysts said reflected an effort to boost domestic oil production and build exposure to renewables.

Sinopec’s capex budget increased 22 per cent from Rmb141.6bn in 2019 to Rmb172.5 bn in 2022, a rise of 22 per cent. CNOOC’s budget increased 30 per cent from Rmb72 bn to Rmb94bn over the same period.

“PetroChina is moving into renewables, Cnooc is using what it knows about offshore to do wind,” said Meidan. “Sinopec, because of its big retail presence, is trying to move into hydrogen and fuel-cell vehicles . . . These things complement what they’re already doing.”

China’s thinking on supply security has developed with its energy mix and experience in the oil market, said Meidan — giving Beijing more confidence that its supply of seaborne crude is resilient to market shocks and geopolitical risk.

They are more sanguine, and I think there’s a greater recognition that dependence on the Middle East also means interdependence,” she said. “China needs them, but the big suppliers also need China.”

[ad_2]

Source link