[ad_1]

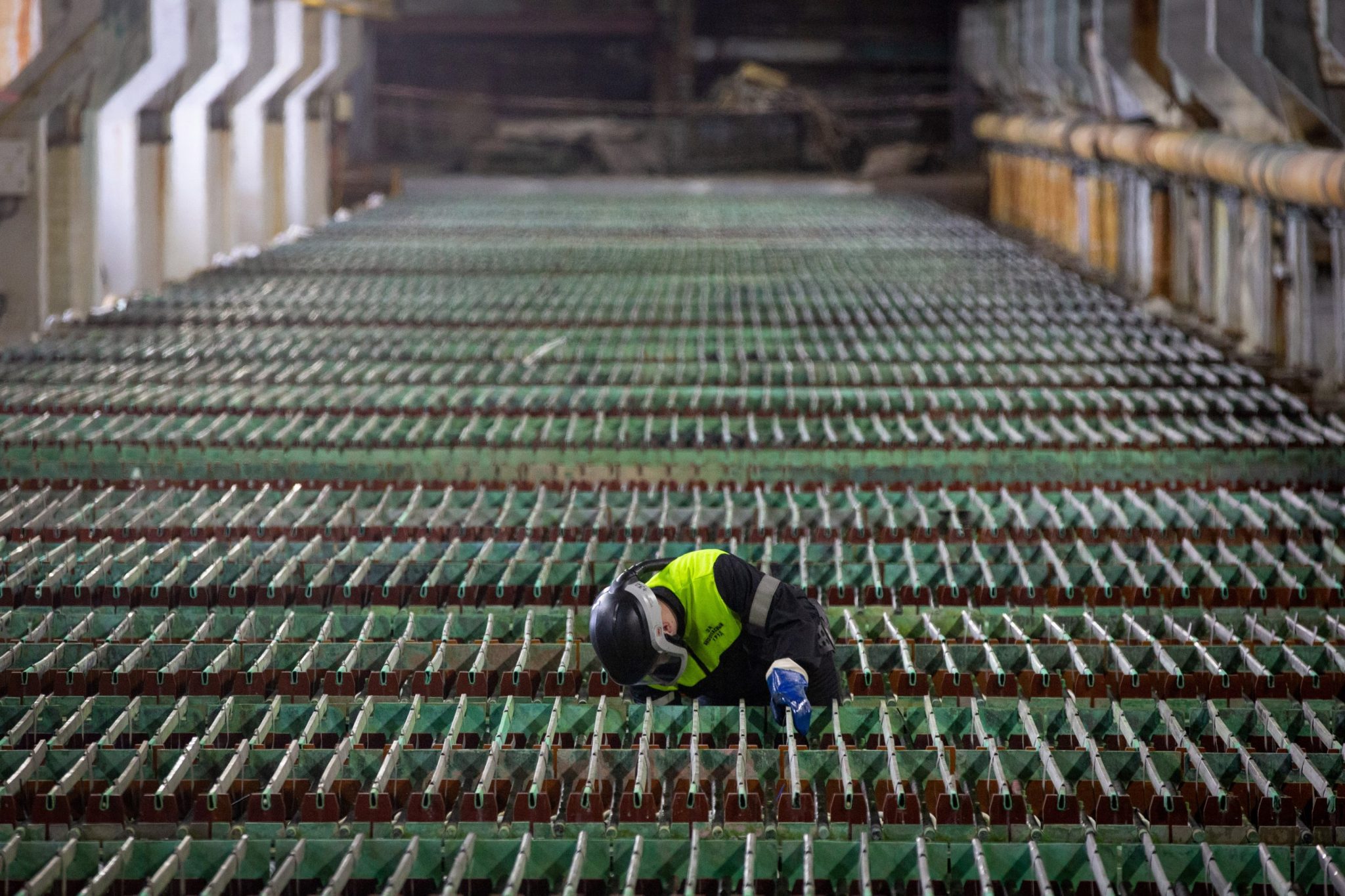

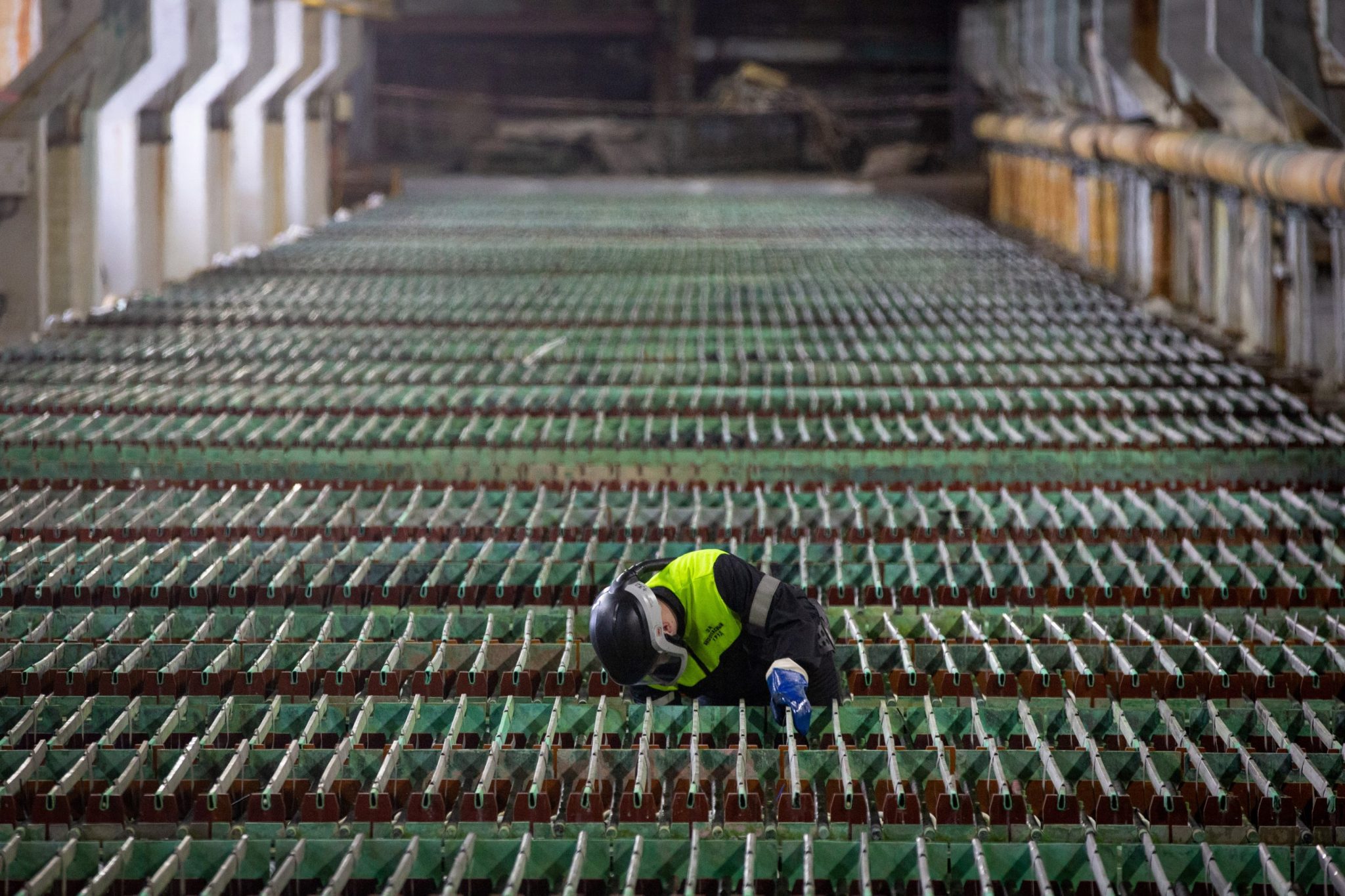

Europe’s biggest copper producer says it was the victim of a major theft that saw it robbed of nearly $200 million worth of the base metal, and company insiders may have played a key part.

In a Tuesday press release, Hamburg-based Aurubis AG said it had identified a €185 million (around $198 million) metals shortage after carrying out an extraordinary inventory in August.

Aurubis said it had paid inflated invoices for scrap metal and other input materials for its copper production, based on samples it claimed had been manipulated.

The group, which generated $18 billion in revenue last year, had already revealed “serious indications” of a shortfall in its metal products in August, confirming the company would miss its profit targets as a result.

Shares in the copper maker plunged as much as 15% the day following that announcement before recovering slightly.

“We are working closely with the investigative authorities and at full speed to get to the bottom of the criminal activities,” Aurubis CEO Roland Harings said in the press release. “We have pulled all of the necessary internal resources together and are using external forensic specialists.”

The company said it was able to partially offset losses from the theft through a $30 million insurance payout and by seizing the assets of the criminals involved.

The identity of those criminals is currently unclear, and a representative for Aurubis told Fortune the matter remained under scrutiny by Germany’s State Office of Criminal Investigation.

However, in June the company revealed it had been the target of “past criminal activities,” with authorities investigating past and present Aurubis employees as well as outside employees working at the group’s site.

That investigation by the Public Prosecutor’s Office resulted in €20 million worth of arrest warrants. Aurubis sought to reassure investors the company itself didn’t play a part in any illicit activities.

It’s unconfirmed whether the purported theft ring highlighted in June was linked to the near $200 million asset shortfall. However, Aurubis said its June investigation was based on intermediate products, which are similar to the scrap metal shortages identified in August.

Investors initially pushed the stock 5.6% higher in the minutes after Tuesday’s reveal, suggesting better than expected losses, before the stock pared back some of those gains. Shares were up 1.5% in early trading Wednesday.

String of high-profile thefts

Aurubis’s missing metal is the latest in a string of high-profile thefts that has caused huge anxiety among metals traders around the security of shipping infrastructure.

Commodities trading is the subject of an unusually high level of bureaucracy and paperwork, leaving it ripe for corruption. The problem is a common one, and most fear is attached to insiders with access to those records.

In February, commodities trader Trafigura Group said it was staring down the barrel of more than half a billion dollars in impairment charges after discovering the nickel cargoes it had traded actually contained much less valuable materials, namely bags of rocks.

It was revealed in March that the world’s largest bank, JPMorgan, was the unfortunate owner of that shipment.

For Aurubis’s part, it said customers had been unaffected by its own shortfall, though it was continuing to investigate the impact of the theft on suppliers.

Crises in the commodities market have helped to rock the London Metal Exchange, the embattled trading house that processed more than $15 trillion worth of trades last year. The group was forced to briefly halt trading in nickel following the Trafigura crisis.

[ad_2]

Source link